market crash, 1000pips up and down within 1 day, a truely scary situation and nightmares to any trading system without stop loss, especially the most profitable but with highest risk strategy - martingale.

I believe martingale is good if we use it properly. As long as you are not going for fast and high profit rate, this system should work well. Proper lot size, proper distance, proper money management and following trend should be able to protect your account from being blown.

3Plus1 version 11 EA comes with 4 sets of EA which any 2 should be used on 1 pair - GBP/USD. New better setting for better probability and account safety. Start making profit and say no more to margin call!!!

4 EA for USD50 or USD25 for members or previous customers.

Saturday, November 8, 2008

Saturday, October 18, 2008

3PLUS1 DAILY TREND Expert Advisor (EA) is better

combining multiple post (3 buy 1 sell or 3 sell 1 buy) strategy with hedging and fixed take profit and stop loss using price movement as its indicator, 3PLUS1 EA should be better or safer for order management and draw down level than most other EA.

Information on Expert Advisor (EA) autotrading robot

Few things newbies should know:

1. EA using standard indicator could be cheated by broker feed leading to wrong entry.

2. EA without take profit or stop loss or with hidden take profit or hidden stop loss is risky when broker disconnect feed.

3. If an EA can't survive August and September 2008 market crash, it is not safe.

1. EA using standard indicator could be cheated by broker feed leading to wrong entry.

2. EA without take profit or stop loss or with hidden take profit or hidden stop loss is risky when broker disconnect feed.

3. If an EA can't survive August and September 2008 market crash, it is not safe.

Wednesday, September 24, 2008

3PLUS1 DAILY TREND EA

Now available for all InstaFx and LiteFx members account registered at link for USD25 only, set of 2 EA at USD25 only!!! 3 versions to choose from, lower risk with lower profitability probability.

see action on Instafx Acc demo login 122966, pw 3plus1v2. revised version with trend detector for each EA and smaller lot size increment for lower risk , extra controlled has been added 17/10/08.

note:

EA ini menggunakan bacaan Daily High , Low dan Close sebagai trend indicator. Indicator lain tidak digunakan kerana telah didapati broker boleh memberikan feed palsu kepada bacaan indicator lain. Strategy multilot digunakan kerana didapati paling berpeluang membuat profit berbanding strategy lain. Dengan penggunaan stop loss yang tertentu dan post yang dibuka dikawal mengikut margin untuk mengelakkan saiz lot yang melebihi setting margin untuk trade dibuka. Hanya buka 4 post maksima pada 1 masa.

updates di sini: http://profitnloss.blogspot.com/

see action on Instafx Acc demo login 122966, pw 3plus1v2. revised version with trend detector for each EA and smaller lot size increment for lower risk , extra controlled has been added 17/10/08.

note:

EA ini menggunakan bacaan Daily High , Low dan Close sebagai trend indicator. Indicator lain tidak digunakan kerana telah didapati broker boleh memberikan feed palsu kepada bacaan indicator lain. Strategy multilot digunakan kerana didapati paling berpeluang membuat profit berbanding strategy lain. Dengan penggunaan stop loss yang tertentu dan post yang dibuka dikawal mengikut margin untuk mengelakkan saiz lot yang melebihi setting margin untuk trade dibuka. Hanya buka 4 post maksima pada 1 masa.

updates di sini: http://profitnloss.blogspot.com/

Saturday, September 6, 2008

3PLUS1 DAILY TREND EA

EA ini menggunakan bacaan Daily High , Low dan Close sebagai trend indicator. Indicator lain tidak digunakan kerana telah didapati broker boleh memberikan feed palsu kepada bacaan indicator lain. Strategy multilot digunakan kerana didapati paling berpeluang membuat profit berbanding strategy lain. Dengan penggunaan stop loss yang tertentu dan post yang dibuka dikawal mengikut margin untuk mengelakkan saiz lot yang melebihi setting margin untuk trade dibuka. Hanya buka 4 post maksima pada 1 masa.

Backtest from jan-august 2008. Running both EA at the same time could possibly make profit of 1445+1235=USD2680, about 31% per month.

This EA are sold at USD300 per set, limited to 10 customers only for better effectiveness.

These EA are meant for serius traders/account managers only.

Latest is 3PLUS1 EA, comes in 2 sets to apply at the same time on same pair.

see action on Instafx Acc demo login 115630, pw 3plus1. revised version with trend detector for each EA.

3PLUS1 is sequel to 2PLUS1 (2PLUS1 is profitable but less exciting), do not expect 4PLUS1 coming after this.

other EA is only USD25 for account registered at Instafx link or Litefx link. Consultation will be provided. minimum acc balance USD100.

Manual trading using this 3plus1 technique will be provided to members.

Sunday, July 27, 2008

2008 RSI exp, multi time frame trading robot

Saturday, July 26, 2008

2008 RSI exp, multi time frame trading robot

believed to be better than the SMA YEN. this EA use RSI on 2 time frame - daily and H4. compounding system used.

backtest run for 6 months plus data, risk level set at 5%, potential return 900%, draw-down about 20%. single post strategy.

1. only USD10 as an upgrades for SMA YEN customer.

2. only USD25 for litefx or instafx members.

3. only USD50 for previous customers.

4. only USD100 for new customers.

Saturday, July 19, 2008

2008 Bless 123 Exp - exploding profit compounding system (under review)

setting for compounding for the profitable Bless 123 expert advisor robot trader. must have unless your system is better than this one. very reasonable drawdown, reasonable stop loss setting.

potential: profit of 1000% in 6 months plus.

will be available for limited number of customers.

price:

1. New customer:

2. Non member with previous purchase:

3. Member with previous purchase:

must have for any (selected) trader. cost at much more reasonable price than most forex classes or system that has been costing more than USD150 but still fail to profit.

frankly, this system is with high profit probability making me reconsidering about selling it.

will be used for interbankfx august trading contest and taking part in Automated Trading Championship 2008.

coding has been tested in live account, need some adjustment due to auto lot calculation for compounding strategy. for the time being will test on live account using normal setting (not compounding, expect 10-20% profit monthly at risk level at least 50% lower than Bless V6 or V8).

Expert Advisor Bless 123

New idea of making profit in trading. Potential 15-20% monthly with reasonable drawdown of about 15%. Double your capital to reduce the risk by 50% and off course same goes for the potential profit. High risk high profit, low risk low profit.

Profit is not guaranteed, only potential.

this will be tested on live account to confirm EA functionality.

Friday, July 11, 2008

Offer for EA customer from 12/07/2008 onwards

EA customer buying EA Bless V8 at USD100 will get free V8 share which the fund will be traded using the EA at InstaFX. Profit will be shared 50-50 and distributed by monthly basis.

For those who are not interested in the share can buy EA at:

1. USD50 for non member's account

2. USD25 for member's account

each purchase is for 1 account number.

A forum for EA Bless customers has been created to provide support and information on any upgrades for this EA.

http://blessv8.freeforums.org/

This forum is only for EA customers.

Any correction or adjustment in coding and strategy will be updated in the forum.

For those who are not interested in the share can buy EA at:

1. USD50 for non member's account

2. USD25 for member's account

each purchase is for 1 account number.

A forum for EA Bless customers has been created to provide support and information on any upgrades for this EA.

http://blessv8.freeforums.org/

This forum is only for EA customers.

Any correction or adjustment in coding and strategy will be updated in the forum.

Thursday, July 10, 2008

Aplikasi EA 2008 Bless V8 utk InterbankFX contest

margin trading strategy, multilot, hedge special settings. manual hedging is problematic when we do not have a strategy to exit. Adjustment of lot size according to market situation is needed to be done on the EA settings for optimum result.

Free things could cost you more than you could ever imagine, at least will cost you your time, unless you could afford to spend it.

All EA customers, please join my yahoo group bellow for any support, or any info on upgrades whenever available.

Click to join forex123456789

email your liteforex/InstaFX acc no & name to forex123456789@yahoogroups.com

Tuesday, July 8, 2008

2008 BLESS V8 together with V7 EA

Floating positions on pair eur/usd closed to focus margin for only 1 pair - GBP/JPY, applying BLESS v7 and BLESS V8 EA together on 1 pair.

This account started on 20th June 2008

Initial deposit USD188.47

Profit so far USD93.34

Floating - all closed

Profit net USD93.34

Capital increase 49% in about 10 trding days.

Price: USD25 for member's account at InstaFX or LiteFX or

Promotion: USD50 for 1st 5 non member's account, 1 purchase is for 1 account only.

Saturday, July 5, 2008

Forex reality

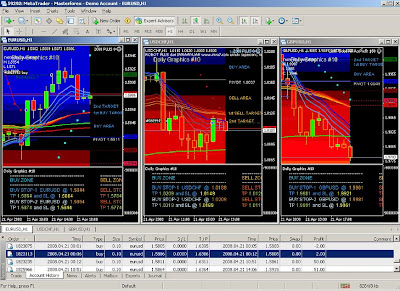

My current standing in InterbankFX monthly contest (above)

Many people claiming that is very easy to make money in FOREX.

Is it really so easy to make money in FOREX?

the answer is YES, as easy as to lose too.

FOREX as any other business, only has 1 guarantee, risk of losing. Enter the world of FOREX only when you are prepared to lose (that is why most people stressed on STOP LOSS). Do not ever trade LIVE until you pass this first requirement.

Basically there are 3 major Trading strategies - Trend follower, Martingale and Hedging. Each strategy has it own advantages. Understanding the requirement of each strategies is important before choosing the ones that suit you most.

Friday, July 4, 2008

EA 2008 BLESS X2 v7 GJ progress

Kuskus indicator given to me by 1 of my FX student (which has been used by Kuasaforex) has been applied to close position manually. Method off application is totally different from the way it is described by Kuasaforex.

Kuskus indicator given to me by 1 of my FX student (which has been used by Kuasaforex) has been applied to close position manually. Method off application is totally different from the way it is described by Kuasaforex.live testing is conducted using live account at InstaFX. Customer will be given investor pw to see the action. As I have stressed so many times, some judgement should be done even using an EA because it only act as an assistant, not your master. I also made some mistakes some times when closing the post manually.

Martingale strategy is applied starting with 0.01lot, 2 EAs with Timer running to Trade at the same time on same pair. Some pairs only require 1 EA, but 2 EAs should be better in term or margin control.

Requirement:

Minimum capital USD250, leverage 1:500.

Indicators for closing manual post:

1. Kuskus starlight

2. Alexcud

3. Stoch oscillator

Paypal is accepted by InstaFX and some other brokers.

Open Paypal account here

Buy and Sell Paypal here

Monday, June 16, 2008

EA 2008 BLESS X2 version 6

Wednesday, June 4, 2008

Wednesday, May 28, 2008

FXCM promotion

FXCM sedang memperbaiki servis untuk platform MT4. Micro lot sedang dalam proses persediaan (1p=10sen). Swap free acc disediakan.

Program affiliate FXCM memberi peluang menambah pendapatan sampingan dengan mudah. Join group FXCM saya untuk mendapatkan peluang dan teknik menjana pendapatan sampingan dengan cara yang mudah.

Anda juga akan mendapat EA 2008 SMA YEN yang tidak akan dijual kepada yang bukan ahli.

hubungi saya melalui ym sihat2u4u untuk maklumat mengenai pembukaan acc FXCM utk menjadi member dan menjana pendapatan sampingan mudah bersama.

"Lets seize any opportunity that comes our way together"

THIS PROMOTION IS PUT ON HOLD, FXCM MT4 IS SAID NOT STABLE YET WITH BUGS AND MICRO ACCOUNT IS NOT ACTIVATED YET TOO.

Program affiliate FXCM memberi peluang menambah pendapatan sampingan dengan mudah. Join group FXCM saya untuk mendapatkan peluang dan teknik menjana pendapatan sampingan dengan cara yang mudah.

Anda juga akan mendapat EA 2008 SMA YEN yang tidak akan dijual kepada yang bukan ahli.

hubungi saya melalui ym sihat2u4u untuk maklumat mengenai pembukaan acc FXCM utk menjadi member dan menjana pendapatan sampingan mudah bersama.

"Lets seize any opportunity that comes our way together"

THIS PROMOTION IS PUT ON HOLD, FXCM MT4 IS SAID NOT STABLE YET WITH BUGS AND MICRO ACCOUNT IS NOT ACTIVATED YET TOO.

2008 SMA YEN live testing

Saturday, May 24, 2008

Expert Advisor (EA) Auto trading Robot

Expert Advisor or EA is a program to do trading automatically based on strategy built into it. It has no brain, but it has trading strategy based on the program written by the programmer.

To write a good auto trading program, the programmer must be a trader. Success of an EA depends on the strategy of the programmer. Different strategy has different requirement and gives different result. Understanding of the strategy and the requirement is important in choosing the EA that is suitable to you.

Basically, higher return rate will require higher risk. Since price pattern is not 100% predictable, there is no strategy can guarantee success, most depends on probability. There is 80-90% probability that pattern is predictable. The uncertainty level even if smaller than the probability could still pose threat of total losses. This is where money management comes in.

Money management refer to percentage of margin used for trading. To me what matter most is how much are you willing to lose?

Stop loss is set for acceptable loss. Some people use 30pips, some 40pips and some never use it yet still making very good profit. Why 30pips? Why no 20pips or why not 40pips? The answer is you should decide what is suitable for you, depending on your strategy. No one can say their stop loss is better than others, because everyone is using slightly or totally different trading strategy.

Another thing to consider is draw down level. This will also depend on your strategy. Some prefer below 5%, some accept 25%, so it also depends on your strategy. No one can say their strategy is better than others based on draw down level.

EA is an assistant, it helps you to simplify calculations, it stick to the chart without getting tired to ensure you do not miss a good post. There are times a trader should decide on an opened position.

To write a good auto trading program, the programmer must be a trader. Success of an EA depends on the strategy of the programmer. Different strategy has different requirement and gives different result. Understanding of the strategy and the requirement is important in choosing the EA that is suitable to you.

Basically, higher return rate will require higher risk. Since price pattern is not 100% predictable, there is no strategy can guarantee success, most depends on probability. There is 80-90% probability that pattern is predictable. The uncertainty level even if smaller than the probability could still pose threat of total losses. This is where money management comes in.

Money management refer to percentage of margin used for trading. To me what matter most is how much are you willing to lose?

Stop loss is set for acceptable loss. Some people use 30pips, some 40pips and some never use it yet still making very good profit. Why 30pips? Why no 20pips or why not 40pips? The answer is you should decide what is suitable for you, depending on your strategy. No one can say their stop loss is better than others, because everyone is using slightly or totally different trading strategy.

Another thing to consider is draw down level. This will also depend on your strategy. Some prefer below 5%, some accept 25%, so it also depends on your strategy. No one can say their strategy is better than others based on draw down level.

EA is an assistant, it helps you to simplify calculations, it stick to the chart without getting tired to ensure you do not miss a good post. There are times a trader should decide on an opened position.

Thursday, May 22, 2008

FXCM workshop untuk member

Learn How to Trade Currencies from the Expert!

Kathy Lien, Chief Strategist of DailyFX.com will teach you how to get started in the currency market. Come and find out what type of trader you are. Learn about what moves the currency market, the different unique characteristics of each currency and how to use technical indicators to gage the trend of the currency market. Walk away with 5 easy to implement trading strategies designed for short and medium term traders.

1.FX Trading 101

2.What is Your Edge

3.Unique Characteristics of Each Currency

4.How to Determine the Trend

5.Common Technical Tools

6.5 Easy Trading Strategies

time: 1900-2300.

date: 6th june 2008, friday.

location: hotel armada pj.

discount for my fxcm members. (not RM150)

contact me on how to get the discount. ym sihat2u4u.

kos seminar yang sangat berpatutan untuk panduan dari Trader yang berpengalaman.

Jom join, you do not know what you will be missing!!!

Kathy Lien, Chief Strategist of DailyFX.com will teach you how to get started in the currency market. Come and find out what type of trader you are. Learn about what moves the currency market, the different unique characteristics of each currency and how to use technical indicators to gage the trend of the currency market. Walk away with 5 easy to implement trading strategies designed for short and medium term traders.

1.FX Trading 101

2.What is Your Edge

3.Unique Characteristics of Each Currency

4.How to Determine the Trend

5.Common Technical Tools

6.5 Easy Trading Strategies

time: 1900-2300.

date: 6th june 2008, friday.

location: hotel armada pj.

discount for my fxcm members. (not RM150)

contact me on how to get the discount. ym sihat2u4u.

kos seminar yang sangat berpatutan untuk panduan dari Trader yang berpengalaman.

Jom join, you do not know what you will be missing!!!

Wednesday, May 21, 2008

2008 SMA MACD - H4 scalper 90% win-loss ratio, trade YEN made easy

MACD added to improve entry point. This is new addition to the setting after reviewing the ATP strategy. Using MACD combined with Fisher, made it easier to predict a reversal. SMA still being used as main reference (with certain limit preset). Suitable for trading GBP/JPY where trending is strong whenever carry trade rewinding and after rewinding is completed.

will be used in FXDD summer Trading competition.

will be used in FXDD summer Trading competition.

Sunday, May 18, 2008

2008 SMA MACD - H4 scalper 90% win-loss ratio, trade YEN made easy

will be used in FXDD summer Trading competition. pending, waiting for paypal.

Friday, May 16, 2008

Liteforex withdraw/deposit status review/monitoring

Scalping no longer allowed (closing a winning position in short time, minimum period to hold a position is 2 minutes)

Withdrawal process seems slowed down. Longer time has been taken for withdrawal (previously, withdrawal normally done within 24hrs).

will update on latest withdrawals made by few friends today Friday 16th May 2008.

withdrawal ecurrency:

jika anda deposit menggunakan kombinasi ecurrency, withdrawal hanya boleh melalui egold. Deposit egold dihentikan.

Deposit ebullion boleh, tapi withdraw tak boleh. So elakkan deposit ebullion.

So kalau nak deposit ecurrency, yang terbaik hanya Liberty Reserve dan lebih elok pastikan acc trading itu acc baru utk mengelakkan alasan yang kurang menyenangkan dari Liteforex bila withdraw.

Withdrawal process seems slowed down. Longer time has been taken for withdrawal (previously, withdrawal normally done within 24hrs).

will update on latest withdrawals made by few friends today Friday 16th May 2008.

withdrawal ecurrency:

jika anda deposit menggunakan kombinasi ecurrency, withdrawal hanya boleh melalui egold. Deposit egold dihentikan.

Deposit ebullion boleh, tapi withdraw tak boleh. So elakkan deposit ebullion.

So kalau nak deposit ecurrency, yang terbaik hanya Liberty Reserve dan lebih elok pastikan acc trading itu acc baru utk mengelakkan alasan yang kurang menyenangkan dari Liteforex bila withdraw.

Saturday, May 10, 2008

2008 SMA - H4 scalper 90% win-loss ratio, trade YEN made easy

anyone interested to try? USD50 for my litefx members only, not sold to others. based on Simple Moving Average, 1 post at a time.

or the 2008 sma EXP potential to lost $10,000 to make $12million (max lots 500), how much? based on Simple Moving Average, 1 post at a time, lot from 1.0 gradually to 500lots.

or the 2008 sma EXP minilite potential to lost $100 to make $7000 (max lots 10), how much? based on Simple Moving Average, 1 post at a time, lot from 1.0 gradually to 10lots.

risk disclosure:

price pattern is not predictable or repeatable. risk of total lost is always there as stated.

Wednesday, May 7, 2008

coming upgrade - variable range EA

EA dengan kebolehan menukar jarak order mengikut perubahan range pair. Strategi tetap sama - long term correction.

EA dengan strategi yang tetap tetapi dengan variable range adjustment mempunyai peluang yang lebih baik utk survive.

EA dengan strategi yang tetap tetapi dengan variable range adjustment mempunyai peluang yang lebih baik utk survive.

Tuesday, May 6, 2008

Tuesday, April 29, 2008

Turtle Rock Plus ver04

Turtle Rock version 4 Expert Advisor 2008.

Turtle Rock EA is becoming more complicated than ever. Better hedging strategies. Price movement based strategy (not the lagging indicator, and it is known that some brokers delay data feed that lead to wrong calculation for indicators). Better than other strategies because trend changes is unpredictable. Less worries on volatility or straddle movement during news.

3 EA:

1. 1 set untuk eur/usd

2. 1 set utk usd/chf

3. 1 set utk close all dipasang di mana2 pair sebagai controller.

gunakan hanya 2 pada 1 masa (kombinasi 1 & 3 atau 2 & 3)

tukar penggunaan antara 1 & 2 mengikut keadaan.

3 setting berbeza - plus 0, plus 1 atau X2. Pilih mana yang bersesuaian dengan capital dan risk level anda.

Hanya USD5 setiap set utk anda forward test. EA ini tidak boleh dijalankan backtest. Panduan lengkap penggunaan/kawalan hanya diberikan untuk pembelian penuh bernilai USD50 bagi setiap set yang di pilih.

Ketahui perkara asas dalam trading - swap effect, margin calculation, leverage effect, etc.

When the broker keep on disconnecting during news or big movement, it is a good sign to leave them. They will not let you make profit. Watch out for this type of broker. Don't waste your time and money with them.

Good broker should have reliable connection, fixed/tight spread during big move/news.

Monday, April 21, 2008

Turtle Rock 3 EA forward test

Sunday, April 20, 2008

Saturday, April 19, 2008

Friday, April 18, 2008

kombinasi Turtle Rock 2008 ver2 dan Power Vstep

Pakej:

1. Turtle Rock hedge eur/usd dan usd/chf. Diperbaharui dengan setting tambahan.

2. Power EA variasi baru dengan fungsi Vstep untuk menghadapi pergerakan volatile yang datang bila-bila masa. 1 setting untuk pair eur/usd dan 1 setting untuk usd/chf.

3 EA pakej pada harga USD100 termasuk online consultation menggunakan ym. untuk yang serius sahaja, daftar acc minilite liteforex di link http://www.liteforex.org/default.php?uid=900000185 dengan modal USD500 minima. Modal yang lebih juga lebih baik.

Percuma Liberty Reserve Turtle Share bernilai USD100. 50% dari keuntungan pro rate diberikan setiap bulan selama setahun.

variasi dalam strategy trading selain money management yang sesuai untuk keuntungan jangka panjang.

pengiraan risiko (imej) berdasarkan fixed step, bagaimana pun EA Vstep mempunyai setting yang berbeza, dengan penggunaan margin yang lebih rendah.

sesuai untuk yang masih selalu rugi.

Saturday, April 12, 2008

strategy trading forex, tips dan fakta

1. trade 1 atau 2 pair pada satu masa, diversify.

2. pastikan anda kenal sifat-sifat pair tersebut - range, faktor gerakan.

3. pilih strategy yang sesuai dengan modal dan corak/sifat trading anda.

4. longterm trading strategy lebih selamat.

5. hedging - buy dan sell pair yang sama, strategy menjaga margin. Lock margin anda pada jarak tertentu, jangan ambil sikap tunggu harga reverse semula, kerana anda mungkin dah kena margin call sebelum harga reverse.

6. broker selalu delay indicator dan harga, ini sudah disahkan dengan multi tf EA.

7. ada broker yang delay price movement semasa position kita profit, dan melajukan price movement bila profit reverse.

8. Pelbagaikan strategy trading untuk mengelakkan broker memahami corak trading anda.

2. pastikan anda kenal sifat-sifat pair tersebut - range, faktor gerakan.

3. pilih strategy yang sesuai dengan modal dan corak/sifat trading anda.

4. longterm trading strategy lebih selamat.

5. hedging - buy dan sell pair yang sama, strategy menjaga margin. Lock margin anda pada jarak tertentu, jangan ambil sikap tunggu harga reverse semula, kerana anda mungkin dah kena margin call sebelum harga reverse.

6. broker selalu delay indicator dan harga, ini sudah disahkan dengan multi tf EA.

7. ada broker yang delay price movement semasa position kita profit, dan melajukan price movement bila profit reverse.

8. Pelbagaikan strategy trading untuk mengelakkan broker memahami corak trading anda.

Sunday, April 6, 2008

Expert Advisor (EA) Fibo Plus Trendaily 2008

strategy berdasarkan kepada teori fibo (correction), trend follower dan margin trading.

hanya USD50 untuk versi 6 bulan, USD90 untuk versi tanpa had.

hanya USD10 untuk versi tanpa had untuk akaun liteforex yang berdaftar di link ini:

http://www.liteforex.org/default.php?uid=900000185

http://www.liteforex.org/mas/default.php?uid=900000185

sila email ke sihat2u4u@yahoo.com no acc trading anda, jenis akaun, selepas mendaftar. arahan untuk bayaran akan diberikan.

bayaran diterima melalui cimb (RM3.4/USD), m2u (RM3.4/USD), Liberty Reserve.

kelebihan menggunakan trading robot (EA):

1. EA membantu anda semasa anda terleka.

2. Pending order secara manual selalu tidak tersentuh.

3. Stop loss manual sering kena (sesetengah broker membuat spike palsu - ini memang pasti).

4. TP manual sering tidak jejak.

5. Broker tidak tahu bila anda akan close trade.

food for thought

Be warned: to fully grasp all of this, you must think beyond all of the "textbook" maxims surrounding entry, exit, RR and MM, and apply lateral thinking, just as I did. If so, I can guarantee (well, almost) that what follows will revolutionize the way in which you think about trading methods. I hope I can express myself simply and clearly enough to make this post a worthwhile read. OK, here goes:

1. The types of order that we use (buys; sells; market or limit orders; profit targets; stoplosses; hedging by taking long and short positions in the same currency pair) are effectively irrelevant. All order types simply add to, or reduce, our net overall position (long or short).

2. To profit, we must be net long while price is rising, and/or net short while price is falling, frequently enough to overcome costs (spread + swap). This applies to all methods, "conventional" or otherwise, without exception, at all times. As long as we are achieving this, our account equity (which is the sum of realized P/L from previously closed positions, plus unrealized P/L from currently open positions) will rise; otherwise it will fall.

3. For as long as our account equity continues to rise overall, we may justifiably assume that we have an "edge". To achieve this, we need to somehow time our orders (i.e. adjust our net position) accurately enough around market reversals, on balance, to be net long while price is rising, and net short while it’s falling. This is the bottom line regardless of whether we’re (in conventional terms) entering, exiting, scaling in, scaling out, realizing a profit, realizing a loss.

4. The result of any one trade is insignificant (if we are "hedging", or scaling in/out, with positions offsetting each other, the idea of an "individual" trade is effectively meaningless, anyway). It is the overall effect on account equity, i.e. net P/L, that is the bottom line.

5. RR (in the conventional sense) is effectively irrelevant. Firstly, TPs and SLs are effectively "offsetting orders" that bring our net long/short position back to neutral. Secondly, everything else being equal, the further away we place our TP from entry than our SL, the less likely the TP will be reached before the SL. All this ultimately amounts to is a compromise between win size (RR), and win rate ("batting average"), i.e. everything else being equal, win size and win rate always operate in exact inverse proportion to each other.

[Note: Since markets are driven by intangibles (mathematically) like greed and fear, the probability that a trade will succeed can’t be calculated in advance. Mathematical edge (or expectancy, or profit factor, call it what you will) can only be measured in hindsight, as the product of win rate and win size.]

I’ll try to explain my point about RR with an example. Let’s say we believe price, currently rising, will likely reverse at heavy overhead resistance. So, following conventional maxims, we set a tight stoploss ("cut losses quickly") just above the resistance point, and then let profits run, as price falls, using a trailing stoploss. However, expectancy is the product of win size and win rate, and the latter is determined by how frequently our assumption of a reversal is correct. That relates to the efficacy of our analysis and forecasting. It's the extent to which the forecasting goes beyond the inverse balance of RR and win rate that provides the edge.

Since exit is effectively nothing more than an offsetting order, entries and exits are ultimately mirror images of each other (just like Merlin said here: Hence, to improve overall expectancy, exits must be likewise somehow be timed accurately around "probable" market reversals, i.e. as described in point 3. (The only difference being that, if we use "conventional" RR/MM techniques, stoploss combined with position size is used to allocate a pre-determined maximum risk with each trade).

So what about "let profits run, cut losses quickly"? Again (if we revert to thinking in "conventional" terms) "let profits run, cut losses quickly" is going to operate profitably to the extent that prices trend. In a trending market, it is a profitable strategy; in a ranging market, the exact reverse applies (more on all of this here: The key is to somehow apply the correct paradigm, as explained in points 2 and 3. (To simply apply the conventional maxim in all situations – assuming that it in itself provides an edge – is to presuppose that forex "trends" more frequently than it "ranges").

If I may digress further..... if I understand correctly, the "let profits run, cut losses quickly" maxim originally applied to equities, and has been "transplanted" into forex. More on this here:

My observations are that while stock trading is purely speculative, allowing prolonged trends while positive sentiment escalates (e.g. the dot-com boom), forex tends (on balance) to revert to a mean, (1) in the long term, due to national economic boom/bust cycles, and government/bank intervention,when economic indicators reach "undesirable" extremes, and (2) in the shorter term, there is mean reversion unless/until news announcements generate the sentiment necessary to move price up/down to another level. (However, I realize that "trends" do occur in forex, on every trimeframe, and that the reality is much more complex than this generalization).

"……It is a MIRACLE that we are making ANY correct statements about a market that was at one point thought to be inherently chaotic and foolish to participate in. Remember that it took several academic papers in the Journal of Finance to prove that the market is not a random walk model.

In fact, the market (and any similar exchange) is inherently chaotic, due to the large number of unrelated participants whose actions both commercial and speculative cannot be previously determined, and whose collective effect, weighed by volume, is even harder to predict. It's a crazy game we are playing if you think about it. Just because you have charts that seem to tell a picture in hindsight does not mean that anything makes sense at all. This is an unknown function with a built in random factor, and we're trying to ride it. F*cking crazy.

At the same time, there seem to be recurring patterns in the market activity that repeat themselves, and which do form both a statistical and an intuitive basis to make time series propositions (aka trades), but that is a topic for another discussion. ......"

"I believe most traders - regardless of them being forex traders, futures traders, commodity traders, or stock traders - fail because they don't have a real edge.

Most of the reasons I read from forums, books, articles only focus on discipline, money management, adequate capital, experience, etc...

However, if you only have discipline, money management and enough capital to trade and you still are missing a real edge, it'll only be a slower death.

I also believe it's a lot easier to be disciplined when you have a real edge than when you don't have any edge.

If you seem to be on the wrong side of the market most of the times, the temptation to tweak your system around is always around the corner. How can you be a disciplined soldier if you have no reward from what you are doing? Unless you are a masochist, I can't really see how someone can stay disciplined using a losing strategy.

What about experience? Well, experience can just help so much. If you still have no edge, your experience will be brutal and will only tarnish your confidence permanently.

In conclusion, a trader fails because his strategy doesn't provide him with an edge good enough to make money.

Many losing traders think that money management can fix this handicap and try their luck with "averaging down" until they blow up their account and go broke.

If you don't have an edge, don't trade. Forget about ratios, money management, discipline, experience...it's all useless if you don't have a real edge."

source: forex factory

1. The types of order that we use (buys; sells; market or limit orders; profit targets; stoplosses; hedging by taking long and short positions in the same currency pair) are effectively irrelevant. All order types simply add to, or reduce, our net overall position (long or short).

2. To profit, we must be net long while price is rising, and/or net short while price is falling, frequently enough to overcome costs (spread + swap). This applies to all methods, "conventional" or otherwise, without exception, at all times. As long as we are achieving this, our account equity (which is the sum of realized P/L from previously closed positions, plus unrealized P/L from currently open positions) will rise; otherwise it will fall.

3. For as long as our account equity continues to rise overall, we may justifiably assume that we have an "edge". To achieve this, we need to somehow time our orders (i.e. adjust our net position) accurately enough around market reversals, on balance, to be net long while price is rising, and net short while it’s falling. This is the bottom line regardless of whether we’re (in conventional terms) entering, exiting, scaling in, scaling out, realizing a profit, realizing a loss.

4. The result of any one trade is insignificant (if we are "hedging", or scaling in/out, with positions offsetting each other, the idea of an "individual" trade is effectively meaningless, anyway). It is the overall effect on account equity, i.e. net P/L, that is the bottom line.

5. RR (in the conventional sense) is effectively irrelevant. Firstly, TPs and SLs are effectively "offsetting orders" that bring our net long/short position back to neutral. Secondly, everything else being equal, the further away we place our TP from entry than our SL, the less likely the TP will be reached before the SL. All this ultimately amounts to is a compromise between win size (RR), and win rate ("batting average"), i.e. everything else being equal, win size and win rate always operate in exact inverse proportion to each other.

[Note: Since markets are driven by intangibles (mathematically) like greed and fear, the probability that a trade will succeed can’t be calculated in advance. Mathematical edge (or expectancy, or profit factor, call it what you will) can only be measured in hindsight, as the product of win rate and win size.]

I’ll try to explain my point about RR with an example. Let’s say we believe price, currently rising, will likely reverse at heavy overhead resistance. So, following conventional maxims, we set a tight stoploss ("cut losses quickly") just above the resistance point, and then let profits run, as price falls, using a trailing stoploss. However, expectancy is the product of win size and win rate, and the latter is determined by how frequently our assumption of a reversal is correct. That relates to the efficacy of our analysis and forecasting. It's the extent to which the forecasting goes beyond the inverse balance of RR and win rate that provides the edge.

Since exit is effectively nothing more than an offsetting order, entries and exits are ultimately mirror images of each other (just like Merlin said here: Hence, to improve overall expectancy, exits must be likewise somehow be timed accurately around "probable" market reversals, i.e. as described in point 3. (The only difference being that, if we use "conventional" RR/MM techniques, stoploss combined with position size is used to allocate a pre-determined maximum risk with each trade).

So what about "let profits run, cut losses quickly"? Again (if we revert to thinking in "conventional" terms) "let profits run, cut losses quickly" is going to operate profitably to the extent that prices trend. In a trending market, it is a profitable strategy; in a ranging market, the exact reverse applies (more on all of this here: The key is to somehow apply the correct paradigm, as explained in points 2 and 3. (To simply apply the conventional maxim in all situations – assuming that it in itself provides an edge – is to presuppose that forex "trends" more frequently than it "ranges").

If I may digress further..... if I understand correctly, the "let profits run, cut losses quickly" maxim originally applied to equities, and has been "transplanted" into forex. More on this here:

My observations are that while stock trading is purely speculative, allowing prolonged trends while positive sentiment escalates (e.g. the dot-com boom), forex tends (on balance) to revert to a mean, (1) in the long term, due to national economic boom/bust cycles, and government/bank intervention,when economic indicators reach "undesirable" extremes, and (2) in the shorter term, there is mean reversion unless/until news announcements generate the sentiment necessary to move price up/down to another level. (However, I realize that "trends" do occur in forex, on every trimeframe, and that the reality is much more complex than this generalization).

"……It is a MIRACLE that we are making ANY correct statements about a market that was at one point thought to be inherently chaotic and foolish to participate in. Remember that it took several academic papers in the Journal of Finance to prove that the market is not a random walk model.

In fact, the market (and any similar exchange) is inherently chaotic, due to the large number of unrelated participants whose actions both commercial and speculative cannot be previously determined, and whose collective effect, weighed by volume, is even harder to predict. It's a crazy game we are playing if you think about it. Just because you have charts that seem to tell a picture in hindsight does not mean that anything makes sense at all. This is an unknown function with a built in random factor, and we're trying to ride it. F*cking crazy.

At the same time, there seem to be recurring patterns in the market activity that repeat themselves, and which do form both a statistical and an intuitive basis to make time series propositions (aka trades), but that is a topic for another discussion. ......"

"I believe most traders - regardless of them being forex traders, futures traders, commodity traders, or stock traders - fail because they don't have a real edge.

Most of the reasons I read from forums, books, articles only focus on discipline, money management, adequate capital, experience, etc...

However, if you only have discipline, money management and enough capital to trade and you still are missing a real edge, it'll only be a slower death.

I also believe it's a lot easier to be disciplined when you have a real edge than when you don't have any edge.

If you seem to be on the wrong side of the market most of the times, the temptation to tweak your system around is always around the corner. How can you be a disciplined soldier if you have no reward from what you are doing? Unless you are a masochist, I can't really see how someone can stay disciplined using a losing strategy.

What about experience? Well, experience can just help so much. If you still have no edge, your experience will be brutal and will only tarnish your confidence permanently.

In conclusion, a trader fails because his strategy doesn't provide him with an edge good enough to make money.

Many losing traders think that money management can fix this handicap and try their luck with "averaging down" until they blow up their account and go broke.

If you don't have an edge, don't trade. Forget about ratios, money management, discipline, experience...it's all useless if you don't have a real edge."

source: forex factory

Friday, April 4, 2008

Perkara yang perlu diketahui dalam Forex

Broker - Liteforex, etc.

Platform - MT4, etc.

Margin - margin cost, margin call, etc.

Leverage - 1:100, 1:200, 1:500, etc.

Pair - eur/usd (eu), gbp/usd (gu), gbp/jpy (gj), etc.

Indicator - Moving Average, Support and Resistant (SAR), kuskus, dolly, etc.

Expert Advisor - auto trading program

Trading Strategy - scalping, hedge, multilot, trend follower, break out, etc.

News - economic news, what moves the market and when, etc.

Teori trading - fibo, correction, etc.

Platform - MT4, etc.

Margin - margin cost, margin call, etc.

Leverage - 1:100, 1:200, 1:500, etc.

Pair - eur/usd (eu), gbp/usd (gu), gbp/jpy (gj), etc.

Indicator - Moving Average, Support and Resistant (SAR), kuskus, dolly, etc.

Expert Advisor - auto trading program

Trading Strategy - scalping, hedge, multilot, trend follower, break out, etc.

News - economic news, what moves the market and when, etc.

Teori trading - fibo, correction, etc.

Akaun di Liteforex

ada 4 jenis akaun yang disediakan:

minilite

100klite

miniforex

100kforex

http://www.liteforex.org/mas/default.php?uid=900000185

http://www.liteforex.org/default.php?uid=900000185

minilite

100klite

miniforex

100kforex

http://www.liteforex.org/mas/default.php?uid=900000185

http://www.liteforex.org/default.php?uid=900000185

senarai produk yang perlu diingati

BOIKOT-PRODUK DARI BELANDA/DUTCH

- Dutch Lady - Susu

- Ferrero Roche - Coklat

- Wall’s - Ais Krim

- Ing -Insurans

- Planta -Magerin

- Lady’s Choice -Magerin

- Lipton -Teh

- Shell -Minyak

- Knorr -Perisa Makanan

- Dove -Mandian

- Sunlight -Magerin/Pencuci Pinggan

- Radiant -Deodoran

- Rexona -Deodoran

- Ponds -Produk Kecantikan

- Kieldsens -Coklat

- Slimfast -Produk Pelangsing

- Lego -Kismis

- Philips -Barangan Elektrik

- Duyvis -Makanan Ringan

- Gouda -Keju

- Robin -Pencuci Lantai/Pakaian

- Ariel -Pencuci Lantai/Pakaian

- Omo -Pencuci Lantai/Pakaian

- Labello -Lip Balm

- Pickwick -Teh

- Venz -Mentega Coklat

- Kinder Bueno -Coklat

- Unilever -Syarikat

- -

- -

- Sunsilk -Shampoo

- Fair & Lovely -Produk Kecantikan

- Lux -Mandian

- Vaseline -Lip Balm

- Cif -Pencuci Lantai

- Surf -Pencuci Kain

- Wishbone -Pencuci Kain

- Doriana - Keju Krim

- Bertolli -Minyak Masak

- Clear -Shampoo

- Breeze -Pencuci Kain

- Sun -Pencuci Kain

Subscribe to:

Posts (Atom)